Outlook

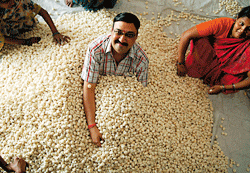

Satyajit Kumar Singh won over hesitant farmers, cautious companies and intrusive traders—by taking all of them along

Reliance Retail is foxed by fox nut’s market ecosystem. This aquatic crop—Euryale ferox salibs, better

known as makhana, which is used as an additive, as a ready-to-eat snack and even has medicinal qualities—has been doing quite well at its outlets. Company officials, therefore, ventured into the hinterland where it proliferates in the ponds and lakes of northern Bihar, and were bewildered by the fragmented and chaotic manner in which the crop is grown, processed and sold.

Over 60% of the 75,000 hectares of ponds in which the crop thrives is owned by the government, which leases them to fishermen co-operatives.

A deep understanding of the socio-political-cultural milieu enabled Singh to forge meaningful partnerships while building his back-end makhana supply chain

These co-ops, in turn, lease the ponds to scores of individuals, impoverished farmers of the mallah community, who are adept at growing and underwater harvesting. The seeds are then popped manually, and sold through agents and middlemen across the state. "Many of these ponds are held by the land mafia and negotiating the maze is tough," says Janardan Jee, Principal Scientist, Indian Council of Agricultural Research, responsible for lending makhana the market profile that it has today.

Reliance, however, had to meet consumer demand. After buying stints at wholesale markets, it recently landed at Satyajit Kumar Singh’s Patna-based company Shakti Sudha Industries. In the last two years, Singh, an old hand at distributing consumer goods, has done the near impossible. He has built a robust back-end supply chain that can be the envy of any big corporate. And now, he is inclined to dictate terms to Reliance.

Reliance is negotiating a requirement of 100 tonnes a month. "I told them I want cash on delivery. The entire chain depends on timely payments. Any deviation can jeopardise it," says Singh. This year, he procured over 3,000 tonnes. While Singh would like to focus on the range of branded consumer packs he has developed, from flakes to makhana kheer, he wouldn’t like to lose the opportunity in institutional sales.

So, how did he build the chain? For several months, he toured Bihar to study this highly unorganised business, and realised it would be impossible to make headway without the participation of panchayats—even for identifying farmers and handholding them. His ‘khet se bazaar tak’ (farm to market) project later made a tripartite agreement with the panchayat, farmer and his company in which the roles of all three were defined, from documentation, training in agronomic practices and purchase guarantees. ID cards were issued to all those who enrolled, over 4,200 in the last count.

As he was dealing directly with farmers, Singh offered around Rs 100 a kg, when the trend was Rs 50-60 a kg. He has had to hike prices to Rs 140 a kg over the last weeks. "The floods in Bihar have hit yields and a shortage is expected," says Singh. Prices, however, were the least of his problems. He had to disengage farmers from vested interests in the system and this, he realised, he could do only if access to institutional credit was ensured. Farmers have to bank on moneylenders and usurious interest rates, even for paying pond lease rents of around Rs 4,000 an acre. "Resource poor and illiterate, they almost function as bonded labourers," says Suman Singh, Secretary, Sakhi, an NGO. The villagers, who heat and pop the seeds, are still in a barter system of sorts. Around 120 kg of seeds yield 50 kg of makhana. Forty kg go to the farmer and 10 kg are retained as labour fee.

To get over the credit issue, Singh worked on two fronts. No bank would fund farmers as the pond lease period was for 11 months, a single season. A sense of ownership was missing and no investments went into pond development. He had to lobby with the government, which finally agreed to a nine-year lease period. Next, he worked with a public sector bank and coaxed his member-farmers to open zero-balance accounts. Till then, none of the farmers even had a nodding acquaintance with the banking system. And leading them into it was exasperating. Some farmers from Jagdishpur in Darbhanga, for instance, demanded their account opening forms be returned when traders led them to believe that the company would draw loans in their name and that they would have to repay.

The old and the new

Makhana payments are now credited directly to the farmers’ accounts and the bank has promised Kisan Credit Cards to those whose transactions fit the norms. Even as these activities were undertaken, Shakti Sudha, to earn the trust of the villagers in the 26 panchayats targeted for the first phase, functioned like an NGO. "We interfaced with the government to ensure entitlements to the villagers, right from the literacy mission to subsidies and assistance under the horticulture mission," says Singh. This year, 42 farmers received Rs 15,000 each under the horticulture plan.

Transportation has been the weak link in many a supply chain. The company decided to turn unemployed rural youth as truck owners. Credit linkages and training were set up, and a band of truckers emerged with assured business from the company. While all of this was happening, Singh had set up office-collection centre-godown in each of the panchayats manned by an employee—makhana mitra (friend). This functioned like a one-stop window for all issues on makhana. And it yielded dividends.

However, the village agent-trader, who has been rendered jobless, endeavour to break Singh’s model. He has now devised a plan for them too—ask them to head his village centres with a 1% commission. They were reluctant with the low rate on offer, but when Singh calculated and showed them that they stood to earn much more than earlier because of the increased volumes, they are turning around.

The biggest lesson he has learnt in this entire exercise in supply chain management is to "include all significant players in the old pattern as stakeholders in your new system, in some form or the other," explains Singh. Makhana popping machines, for instance, are being developed and tweaked with the CFTRI, Mysore. However, instead of ejecting those depending on this for their livelihoods, he would like to distribute these machines to farmer’s collectives.

Shakti Sudha’s turnover is nudging Rs 50 crore. Singh hopes to expand to 126 blocks, reach 40,000 farmers and touch a turnover of Rs 100 crore by 2012. "The orphan crop that was makhana is finally coming into its own," says Janardan Jee.